|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Understanding FHA Approval Guidelines: Key Features and HighlightsThe Federal Housing Administration (FHA) provides a path to homeownership for many Americans. Understanding its approval guidelines is crucial for prospective homebuyers. This article delves into the essential features and steps involved in the FHA approval process. Eligibility CriteriaBefore applying for an FHA loan, it is important to understand the eligibility criteria. These guidelines ensure that the loan is accessible to those who need it most. Credit Score RequirementsThe FHA has more lenient credit score requirements compared to conventional loans. A minimum score of 580 is required for maximum financing, while a score between 500 and 579 requires a 10% down payment. Income and EmploymentStable income and employment history are vital. The FHA requires proof of steady income for the past two years and consistent employment. Property RequirementsNot all properties qualify for an FHA loan. The home must meet certain standards to ensure it is safe and livable. Appraisal and InspectionAn FHA-approved appraiser must evaluate the property. This appraisal ensures the home meets the minimum property standards and is worth the sale price. Condition and Safety

Financial ConsiderationsUnderstanding financial requirements is critical. FHA loans offer lower down payments, but other costs must be considered. Down Payment and Closing CostsFHA loans require a lower down payment of as little as 3.5%. However, closing costs can add up, so budgeting is essential. For more information on financing, you might also consider looking into jumbo mortgage rates texas if you are in the high-end housing market. Mortgage InsuranceFHA loans require mortgage insurance premiums (MIP) to protect the lender. This cost is added to the monthly payment. Frequently Asked Questions

In conclusion, understanding FHA approval guidelines can simplify your path to homeownership. By meeting these requirements and being informed about potential financial responsibilities, you can ensure a smoother, more predictable buying experience. https://www.fha.com/fha_loan_requirements

FHA Loan applicants must have a minimum FICO score of 580 to qualify for the low down payment advantage which is currently at 3.5%. If your credit score is ... https://www.hud.gov/sites/dfiles/OCHCO/documents/40001-hsgh-update15-052024.pdf

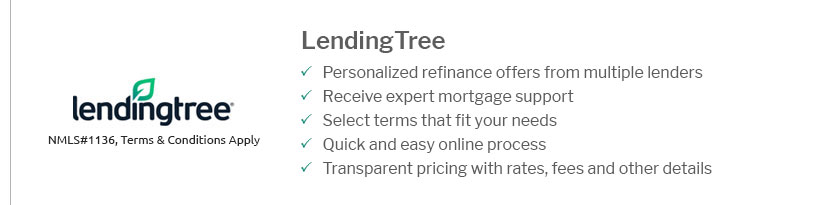

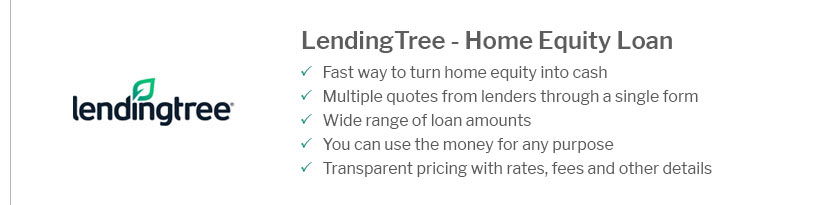

... Guidelines and USPAP (04/18/2023) ... FHA approval (both Title. II Mortgagees and Title I Lenders) and the ... https://www.lendingtree.com/home/fha/

You may qualify for an FHA loan with a score as low as 580 if you're making the minimum 3.5% down payment, or 500 if you're putting down 10% or more.

|

|---|